COVID-19 coronavirus outbreak prompts Malaysian conventional and Islamic banks to offer deferment of loans repayment

KUALA LUMPUR - Conventional and Islamic banks in Malaysia have been racing to the assistance of customers whose businesses are being affected by a coronavirus outbreak centred on nearby China by offering them temporary deferment of loan repayments.

Maybank is the latest to offer financial relief including restructuring and rescheduling of financing, and a moratorium of up to six months on loan repayments.

This package will be open to both business and individual customers affected by the current situation, and will be assessed on a case-to-case basis.

“We do understand that this sudden turn of events arising from the virus outbreak have impacted some of our customers across various industries, and also individually,” said Maybank president and chief executive Abdul Farid Alias in a statement announcing the move.

Customers whose businesses have been affected by the coronavirus outbreak, or COVID-19, should contact their branch to discuss their options.

“Should the situation persist, the bank will consider the possibility of extending the moratorium and financial relief for a longer period,” Abdul Farid added.

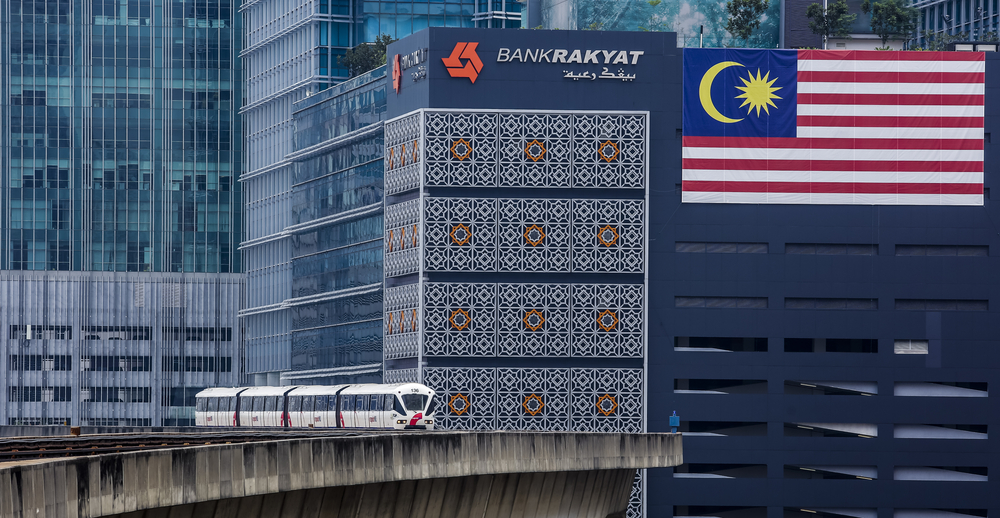

Last Sunday, Bank Simpanan Nasional (BSN) and Bank Rakyat, an Islamic lender, were the first to announce similar assistance schemes, followed by Public Bank’s conventional and Islamic operations on Monday.

“As the coronavirus is expected to affect industries and businesses, the bank hopes that its relief assistance programme will assist in overcoming the short-term financial constraints faced by the customers,” Sulaiman Abd Manap, Public Bank’s senior chief operating officer, told Salaam Gateway.

“So far we have received some inquiries from customers and are monitoring the situation closely.”

The bank is offering moratorium of up to six months for monthly loan repayments. It will also accommodate requests by affected customers to restructure or reschedule their loans and financing to help their cashflow.

As of February 11, the World Health Organisation reported 1,017 deaths from the virus, with 42,708 confirmed infections. There are 395 confirmed cases in another 28 other countries, with one death recorded in the Philippines.

Malaysia has so far seen few cases of the virus. According to the WHO’s February 11 situation report, 18 infections have been identified, of which 15 happened during travel in China.

Currently, the country has restricted arrivals from the worst affected parts of China. This will be extended to include other regions locked down by the Chinese government.

“We don’t want to have any cases from Malaysians to Malaysians who have not travelled to China or have contact with Chinese nationals. Those are the sporadic cases that we are trying to curb,” deputy prime minister Wan Azizah Wan Ismail told local press on February 8.

According to Siouxie Wiles, an associate professor of microbiology at the University of Auckland, the preventative measures Malaysia has been taking have been successful so far.

“Malaysia has not had many cases, so clearly the measures of testing people with a temperature and isolating them are working,” she told Salaam Gateway.

“How long can you do that for, and how much worse are things going to get in mainland China: we don’t know that yet.”

IMPACT ON ECONOMY

Despite the measures being taken to prevent more cases in Malaysia, there is concern that COVID-19 will damage the Malaysian economy over time.

Businesses dependent on revenues from tourism could be dealt a particularly heavy blow, after nearly 3 million annual Chinese visitors arrived in Malaysia in 2018, according to Malaysian Association of Tour and Travel Agents figures.

If Malaysian authorities decide to increase its embargo on departure points from China, these businesses would be among the first to bear the brunt, though others will follow if China’s economic growth is slowed further by the virus.

Malaysia’s economy is intrinsically tied to China’s, from which it receives a fifth of imports and which accounts for 16% of its exports.

The central bank today reported Malaysia’s economy grew a lower 4.3% for 2019, compared to 4.7% in 2018, and warned the country will be affected by the outbreak of the virus, particularly in the first quarter.

Economists and analysts concur.

Alliance Bank Malaysia chief economist Manokaran Mottain expects a dramatic 0.2% reduction in GDP as a result of the outbreak.

Meanwhile, AmBank chief economist Anthony Dass goes further, saying widespread infection could lower Malaysia’s GDP growth by 0.6 to 1% for the financial quarter it peaked.

Other local industries from electrical and electronics to aviation and plantation rely heavily on Chinese demand. Experts say any disruption to China’s economic growth due to the virus outbreak will do damage to the global supply chain.

Reuters reports that the government is putting together a stimulus package for businesses, citing the Ministry of Economic Affairs.

"Today's meeting discussed specifically the impact of the 2019 novel coronavirus outbreak on the country's economic growth," the ministry said in a statement.

"Among the sectors identified are the services sectors such as the tourism, retail and aviation industries.”

(Reporting by Richard Whitehead; Editing by Emmy Abdul Alim [email protected])

© SalaamGateway.com 2020 All Rights Reserved