Dubai Islamic Bank net profit up 9.7 pct for first 9 months

Dubai Islamic Bank (DIB), the United Arab Emirates’ biggest Shariah-compliant bank by assets, reported a 9.7 percent rise in net profit to reach 3.3 billion dirhams ($898.9 million) for the nine months ending September 30 compared to the same period last year, according to Salaam Gateway calculation.

DIB reported net income of 5.7 billion dirhams for the nine months ending September 30. This is a 12.6 percent rise year-on-year, led by a strong 130.2 percent jump in other income and 18.9 percent increase in income from financing and investing.

The ‘other income’ category normally includes realised gains on disposal of investments in sukuk, gains on disposal of associates and joint ventures, and services income.

Growth in these areas lifted net profit, which was hit by a 103.5 percent rise in impairment charges to 618.7 million dirhams.

PLUNGING PROFITABILITY

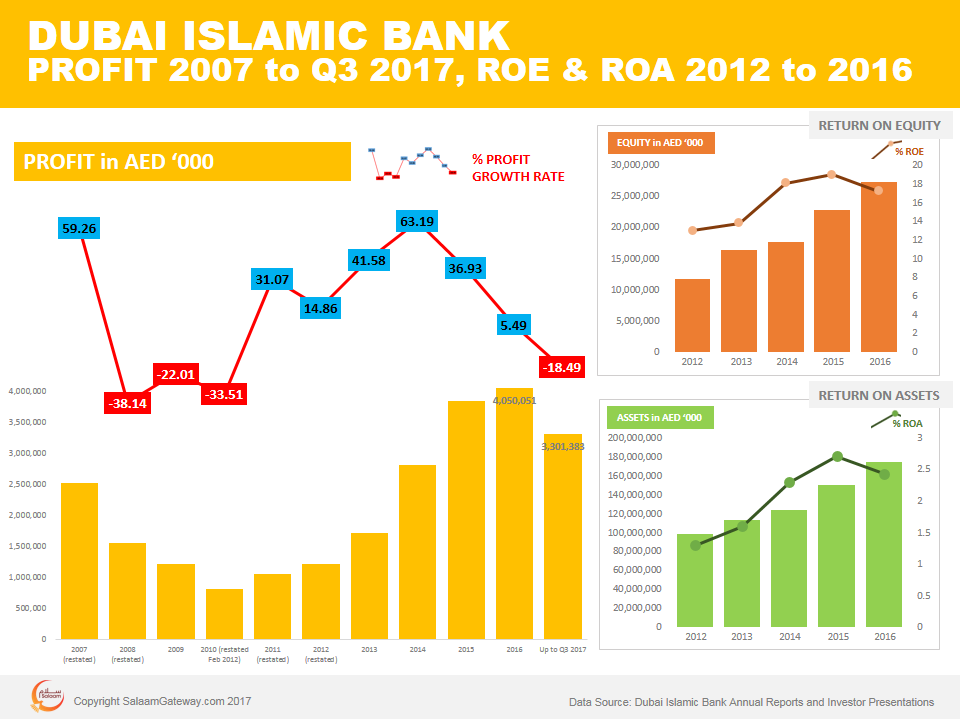

DIB is still recording positive annual net profit growth but the rate of that growth has been plunging since it reached the 10-year high of 63.19 percent in 2014, according to Salaam Gateway calculation.

In 2016, net profit growth plunged to 5.49 percent.

Returns on assets and equity also dropped in 2016. ROA dipped to 2.43 percent in 2016 from 2.71 percent in 2015 and ROE declined to 17.2 percent in 2016 from 19 percent the year before, according to DIB investor presentation documents.

ROA measures how efficient the business is at using its assets to generate profit. It is expressed as a percentage The higher the ROA the better, indicating that the company is earning more from its assets.

Similarly, ROE measures how good the business is at using its equity to generate profit.

($1 = 3.6726 dirhams)

READ ALSO: Dubai Islamic Bank posts 26 pct Q3 profit rise

© SalaamGateway.com 2017 All Rights Reserved

Â

Â