Malaysia banking on Value-Based Intermediation to provide growth for slowing Islamic finance industry

This week, assistant governor of Bank Negara Malaysia (BNM), Marzunisham Omar, told local press the focus for the country's Islamic finance industry will be "quality growth", emphasising the central bank's Shariah-rooted Value-Based Intermediation (VBI) initiative launched in July this year.Â

The central bank's strategy paper for the VBI defines the concept as: "An intermediate function that aims to deliver the intended outcomes of Shariah through practices, conduct and offerings that generate positive and sustainable impact to the economy, community and environment, without compromising the financial returns to the shareholders."

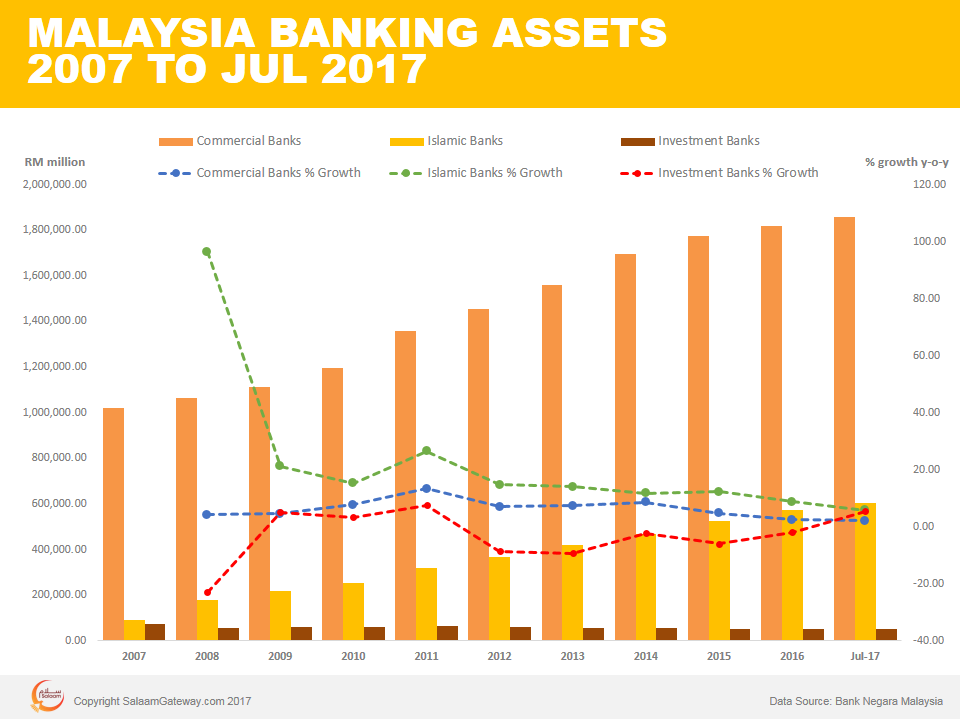

The VBI initiative comes at a point when Malaysia's Islamic finance industry's growth is on the decline; asset growth has dropped from around 26 percent in 2011 to around 8 percent in 2016.Â

While the growth of Islamic finance industry assets in Malaysia is still higher than that for conventional banks, the fact that it has been nose-diving is a concern for the nation's authorities and market players.Â

SHARIAH ROOTED

Malaysia’s intention to transition its Islamic finance industry from being Shariah-compliant to Shariah-based was articulated in the Capital Market Masterplan 2 for 2011 to 2020 that was released in 2011 by the Securities Commission.

The Shariah-based approach demands alignment of products and services to maqasid al Shariah, or the goals of Shariah, which seek to protect and preserve the benefits and interests of society and the acquisition of wealth in a fair, transparent and accountable manner. Â

Most current Shariah-compliant financial products and services originate from conventional finance but are structured in such a way that they comply with Shariah.Â

In the 2011 release of SC's Capital Market Masterplan 2, the thinking behind the transition was to develop risk-sharing in the Islamic capital market and “offer significantly different pricing and returns characteristics.â€

It also stressed the need to focus on product innovation and development to provide a comprehensive range of Shariah-based products.

The VBI strategy paper demonstrates a higher level of maturity and development of the thinking behind moving from 'mere' Shariah compliance to being Shariah-based. The strategy paper says that VBI "shares similarities with several well-established concepts such as Environmental, Social and Corporate Governance (ESG), Ethical Finance and Sustainable, Responsible, Impact Investing (SRI)."

The vision includes long-term objectives not just for profit but also for greater socioeconomic impact, which will re-orient financial institutions to recognise other types of value such as social value, human capital and intellectual property, says the strategy paper. It also covers performance measurement that considers both financial and non-financial aspects.Â

PRACTICE

In late August this year, central bank deputy governor Abdul Rasheed Abdul Ghaffour said the central bank was developing a scorecard with Islamic banks to measure the adoption of VBI initiatives, which he said would be rolled out in phases. Â

Islamic banks in Malaysia have gotten together to establish the VBI Community of Practitioners (COP) to help the adoption and implementation of VBI.Â

© SalaamGateway.com 2017 All Rights Reserved

Â