UK Islamic finance 2021: Opportunities loom amid Brexit and pandemic gloom

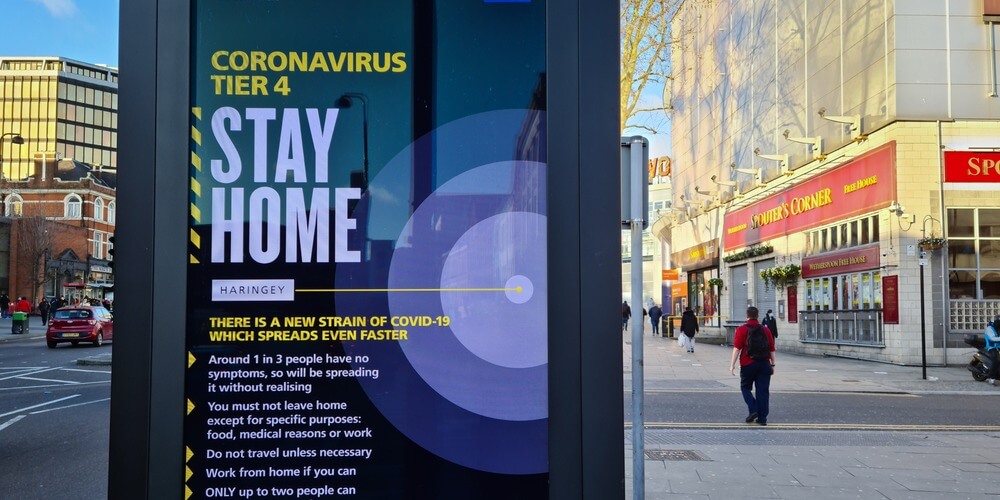

LONDON - The United Kingdom’s economic uncertainty continues with the twin blows of Brexit and the havoc caused by the COVID-19 pandemic.

Like their conventional peers, the UK Islamic finance industry faces economic risks particularly with regards to the housing market. At the same time, Islamic banks are less likely to feel the immediate shocks of Brexit as they are more focused on the domestic market.

However, in the near-term, domestic banks will experience asset quality and profitability pressure due to the pandemic, according to Arif Bekiroglu, Vice-President, Senior Analyst at Moody’s.

“Over the medium term, the operating environment for domestic issuers will become more challenging than if Brexit had not occurred given that we expect the UK economy will be smaller as a consequence of Brexit, which in turn will moderate balance sheet growth opportunities,” Bekiroglu told Salaam Gateway.

Among the risks of leaving the European Union was losing the right to the passporting scheme that previously enabled UK firms to conduct business in the countries of the EU and EEA without the need for further local authorisation.

Since the UK left the EU this year, local firms have to seek individual country authorisation to operate in that market.

Following the UK-EU Trade and Cooperation Agreement both sides have agreed to establish a joint Declaration on Financial Services Regulatory Cooperation.

The framework aims to “…establish durable and stable relationship between autonomous jurisdictions. Based on a shared commitment to preserve financial stability, market integrity, and the protection of investors and consumers.”

Both the UK and EU have said they hope to sign a Memorandum of Understanding establishing the framework for this cooperation by March 2021.

BANKS

Gatehouse, one of six local standalone Islamic banks, said Brexit has had little immediate impact on its operations.

“There’s currently no impact and no direct effect is expected in the immediate future due to the fact our primary activity focuses on UK property and UK-based savings,” said Charles Haresnape, CEO at Gatehouse Bank. “However, any major lasting impact on the UK economy in general caused by Brexit could eventually filter through and have an effect in future.”

Another local Islamic bank is showing confidence in the UK economy. “Our core businesses of real estate finance and development and private banking have not been adversely affected to-date, and the core fundamentals of the UK are unchanged,” said Andrew Ball, CEO at BLME.

With regards to how the UK property market will perform this year, Haresnape said it is very difficult to predict the market in the short-term.

“There’s likely to be a slowdown after the Stamp Duty allowance ends, and potentially a host of sales may be called off if they’re not going to make it over the line by March 31, resulting in a temporary lull in the market,” he explained.

Paul de Croos, Head of Real Estate Finance at BLME, believes 2021 will be a challenging year for the UK real estate market.

For commercial assets, he said there will be two competing themes: an underlying recovery in activity as coronavirus restrictions are eased will come up against the long-term structural impacts of the pandemic.

“In the commercial market, failing businesses will vacate commercial units, causing headaches for landlords and investors,” said de Croos. “Increased unemployment will depress residential property prices. However, undersupply and investor confidence will guard against the most extreme fluctuations.”

Nonetheless, others are optimistic on the long-term prospects for the UK property market.

“[However], over the long-term UK property has a history of strong performance and I believe this will continue,” said Gatehouse’s Haresnape. “This track record will undoubtedly attract investment from overseas investors in UK housing and it is likely that discerning Middle Eastern investors will be at the forefront of that influx of capital.”

BANK OF ENGLAND’S ALF

Among the most significant developments this year will be the Bank of England’s alternative liquidity facility (ALF), which it announced in December.

It will enable UK Islamic banks to invest in high quality liquid assets (HQLA) requirements, enabling them to hold reserves-like assets in a non-interest-based environment. This will help banks manage their liquidity in a more efficient way.

Arshadur Rahman, Manager in the Sterling Markets Division at the Bank of England said the ALF is not yet live, as BoE is currently preparing internally for the onboarding of participating firms. He said that specific timelines will be communicated in due course and declined to comment on the onboarding process for specific firms.

“Only UK banks which face formal restrictions from engaging in interest-based activity will be eligible to apply for the ALF,” he said, adding that non-banks will not be eligible to apply.

“The ALF is a deposit facility in which participants will be able to place deposits and withdraw them readily, either in part or in full,” he explained. “This means it will be up to participants to decide the term over which they place deposits in the facility.”

Market participants have welcomed the arrival of the ALF and believe it will benefit the industry substantially.

Mark Lynch, head of treasury at BLME, noted that UK Islamic banks have for many years sought a “level playing field” in respect of access to the UK Sterling Monetary Framework.

“One of the benefits of holding regulatory liquidity at Bank of England’s ALF will be that institutions won’t have to concentrate so much of their HQLA in U.S. dollar-denominated sukuk – primarily issued by Islamic Development Bank,” he said.

However, he said there will still be a reasonable case for holding some in these longer-term sukuk.

“Yields on such sukuk, for example, may exceed the remunerated balances held in ALF and, depending on the institutions’ composition and cost of funding, this might be a reason for some to maintain a healthy balance between Sterling held with the Bank of England and held in sukuk,” he said.

Other industry players have called policymakers to continue the momentum.

“There are huge opportunities to level the playing field even further,” according to Maisam Fazal, chief commercial officer, Al Rayan Bank. “A supportive regulatory infrastructure will help the Islamic finance industry to access untapped growth sectors and we’re confident we can move in the right direction with the Government’s support.”

The Bank of England is open to listening and collaborating with practitioners.

“We see the development of the UK Islamic finance sector being very much a market-led phenomenon, though of course we aim to ensure the necessary financial infrastructure is in place to help it grow,” said Arshadur Rahman. “So aside from the ALF, we are very much in the mode of listening and learning to other stakeholders in this sphere.”

MIXED SUKUK ACTIVITY

The UK’s second sovereign sukuk was originally planned for early 2020 prior to the COVID-19 pandemic. However, a deal has yet to materialise.

It will be a litmus test of the government’s recommitment to the domestic Islamic finance industry.

A UK Treasury official told Salaam Gateway that Islamic finance will remain an important priority for HMT and the UK’s second sukuk issuance will remain a key part of their wider strategies in this area.

The UK sold its first-ever sukuk in 2014, consisting of a five-year £200 million ijarah note.

Since 2014, there has been little activity in the country’s sukuk market. In February 2018, Al Rayan Bank issued a debut £250 million sukuk, which followed a Shariah-compliant equivalent to a residential mortgage-backed security.

Stella Cox of DDCAP said that until recently the scale of issuance hasn’t really developed as envisaged since the maiden issue. In 2020 there have been examples of UK corporates going to market with issues that are not of benchmark size, which is positive, said Cox.

“In recent years, many of the banks originating sukuk have been strategically focused on those benchmark-sized transactions, for which opportunities in the UK domestic market are more limited,” she explained.

A second sovereign issuance is unlikely to lead to a large pipeline of issuers seeking GBP sukuk.

Qudeer Latif, Partner, (Global Head of Islamic Finance) at Clifford Chance, said that in the current low interest rate environment, a UK-based corporate issuer is more likely to sell conventional bond or debt instruments unless there is a drive from management or a specific shareholder with a connection to the Middle East or Islamic world. “The transaction cost involved in issuing sukuk is higher and it is also more time consuming, although this has decreased over the past few years.”

He also downplayed the possibility of a sovereign green sukuk in the immediate term.

“I doubt we will see a green sukuk anytime soon,” he said. “The UK has yet to issue a conventional green bond and will need to develop a yield curve for green bonds/gilts before considering a sovereign green sukuk.”

Whilst quasi sovereign and corporate sukuk activity is limited, there is scope for SME sukuk. For example, Bedford Row Capital, a boutique fixed income structuring house, is keen to originate SME in the UK and Europe.

FDI

In a post-Brexit environment, Islamic finance can play a role in attracting inward foreign direct investment as well as in UK trade negotiations with Islamic jurisdictions like the Gulf or Malaysia.

In a recent note, Knight Frank predicted that Middle East investors will return to the UK’s commercial property market despite the current national lockdown. The real estate specialists forecast that 2021 will see a 14% rise in Middle Eastern investments to £1.6 billion. The company estimated that Middle East capital flows into the UK dropped 6% to £1.4 billion last year due to lower oil prices and the coronavirus.

As the UK reconnects with the Muslim populations in Commonwealth nations, this may provide additional opportunities via their potential desire to diversify into UK residential investments or banking services, according to Moody’s Arif Bekiroglu.

“Historically, UK Islamic banks have been taking part in the financing of property and infrastructure developments in the UK via syndications,” he said. “Gulf sovereign wealth funds invest in the UK, particularly in the healthcare, education and social housing sectors.”

EXPORTS

In addition, Islamic finance can also play a role in UK exports. UK Export Finance (UKEF), the country’s credit export agency, is likely to play a role in facilitating this.

In the past, UKEF guaranteed sukuk and other Shariah-compliant transactions. For example, in 2015, it supported the delivery of four Airbus A380 aircrafts to Emirates Airlines, by guaranteeing the company’s sukuk.

“UKEF is able to support Shariah-compliant facilities for any overseas buyer, with UKEF already utilising its guarantee for landmark Islamic finance transactions in support of UK exports,” said a UKEF spokesperson. “UKEF routinely supports projects in Islamic countries, including in the Gulf.”

He added that the UAE, Oman and Bahrain were the top three destinations for exports supported by UKEF last year. The agency has also expanded its international network in markets strong in Islamic finance like Indonesia and Turkey, as well as those with a growing presence in Africa.

“Appealing to these markets is an incredibly important part of our ability to fulfil our mandate to support UK exports,” said the spokesperson.

TAKAFUL AND FUNDS

Despite the progress in the Bank of England’s ALF, and sukuk, areas like takaful remain unrealised, say practitioners.

“The opportunities for Islamic finance lie in insurance due to a shortage of takaful providers in the UK,” said Tahir Ebrahim, manager at Islamic Finance Advisory and Assurance Services (IFAAS).

Stella Cox said that despite a number of compelling launches, the industry has not yet found a UK Shariah-compliant insurance market business that has fully succeeded and come to enjoy prominence over the medium term.

She said reasons cited have been lack of demand, scalability, appetite amongst the firms active in the market and insufficient financial resources.

“Possibly all are relevant but London has the deepest insurance and re-insurance market with unequalled professional services and, at some point, I am certain that the right model will emerge,” she said. “In fact, pre-pandemic, Lloyds’s of London was proactively inviting Shariah-compliant insuretech to apply for admission to its accelerator cohort.”

Qudeer Latif believes the takaful sector is going to be difficult to develop unless a larger, more established insurance player shows interest in opening an Islamic insurance unit.

Islamic asset management is also a growing area. Most recently, Schroders, a UK-headquartered asset manager with £563.3 billion in assets under management, launched a Global Islamic Equity Fund in December.

“There is growing interest from large UK-based asset managers to establish Islamic equity funds and/or sukuk funds,” said Latif. “Whilst there are some internal organisational challenges for different asset managers, the introduction of more halal products will lead them to consider it.”

SDGs, COP26

In November, the UK will host the 26th U.N. Climate Change Conference of the Parties (COP26) in Glasgow. As a result, the role of the Sustainable Development Goals (SDGs) will also likely play a greater role in the country’s Islamic finance industry this year.

Omar Shaikh, a board member at the UKIFC, said his organisation’s global Islamic finance and SDG Taskforce has gained considerable momentum.

“We have three new reports scheduled, have launched a Pakistan Working Group with the State Bank of Pakistan, and we have partnered on the Path To Cop initiative leading the #FaithInSDGs campaign within,” he said.

(Reporting by Hassan Jivraj; Editing by Emmy Abdul Alim [email protected])

© SalaamGateway.com 2021 All Rights Reserved